Buy Klarna Verified Account

- Lifetime Free Support

- 100% legal

- The following Policy

- Full Refunds

- 24/7 Free Support

- Instant Delivery

😊 9 people 5 people 4 people 10 people 7 people are viewing this right now

We accept

Instant Automated Delivery Systems.

😊 41 people 45 people 55 people 43 people 58 people are viewing this right now

We accept

Contact with us 24/7

Telegram: @airvcc

😊 41 people 45 people 55 people 43 people 58 people are viewing this right now

We accept

Table of Contents

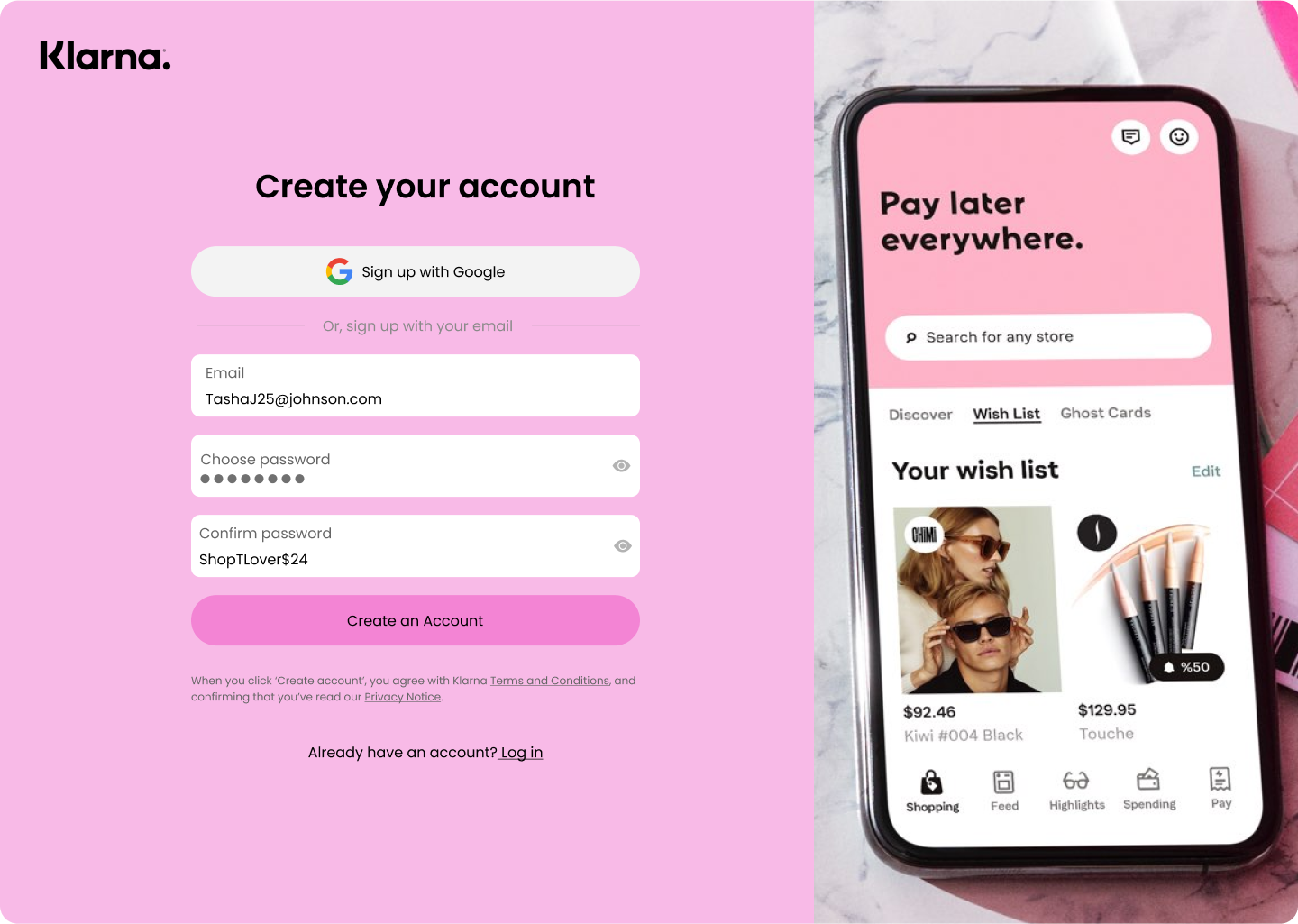

ToggleBuy Klarna Verified Account from us

Klarna Bank AB, commonly known as Klarna, is a Swedish fintech enterprise that offers online economic offers include ch includes payments for online storefronts and direct bills g side put up-purchase bills.

Klarna offers some payment options, along with direct payments, pay after delinstallmentnstallmeincludesdech includes our flagship Pay In 4 application. We offer a clean one-click on buy enjoy for our customers, no matter how they pay.

Buy Verified Klarna Accounts – How does the Klarna work?

Do you want to make a purchase but don’t have enough finances to pay upfront? Klarna gives a pay-in-4 payment plan that allows you to cut up your purchase into 4 same installments, supplying you with the power to pay over the years. With Klarna’s charge plan, you can buy what you need now and pay later without any hobby or hidden charges.

Buy Klarna Accounts – Is Klarna a credit card?

The Klarna Card is a virtual Visa card that you can use to make purchases. You can make online online without delay the usage of the cardboard at a retailer’s checkout or by way of including it in Apple Pay or Google Pay. You can use your digital Klarna card anywhere Visa is customary.

Buy Klarna Verified Account – Does Klarna price a charge?

There isn’t any annual fee for the use of Klarna. However, a few services and charge alternatives can incur extra prices. There aren’t anwhilenses whilst you operate: The Klarna app.

Buy Verified Klarna Account – What financial institution does Klarna receive?

Klarna, the popular buy now, pay later payment alternative, accepts diverse debit and credit cards to facilitate your purchases. You can use Visa, Discover, Maestro, and Mastercard to make bills via Klarna. However, it’s worth noting that pay-as-you-go playing cards aren’t commonplace. Also, if you’re a Capital One cardholder, it’s essential to understand that Capital One doesn’t assist buy now, pay later products like Klarna.

Using Klarna with your chosen debit or credit score card is a convenient way to manipulate your purchases over time. With Klarna’s price plan, you may purchase what you need now and cut up the fee into 4 equal installments. And by the usage of a debit or credit score card that Klarna accepts, you may revel in the flexibility and convenience of Klarna’s payment plan with one problem.

In summary, Klarna accepts a number er debit and credit score cards, inclusive of Visa, Discover, Maestro, and Mastercard. However, prepaid cards aren’t prevalent, and Capital One doesn’t aid buy-now, pay-later merchandise like Klarna. By usage of a familiar debit or credit card with Klarna’s fee plan, you may revel in the advantages of dealing with your bills through the years whilst chasing for what you want.

Can I withdraw cash from Klarna?

If you’re looking for a way to finance your purchases or pay later, the Klarna Card may be the answer you need. The Klarna Card is designed to work seamlessly with Klarna’s fee options, allowing you to make purchases now and pay through the years.

One critical factor to o be aware of is that the Klarna Card doespermitsncoinermit coins withdrawals. However, you may use the card to access Klarna’s price options at any merchant that accepts Visa. This means you can take advantage of Klarna’s price plans and purchase now, pay later options everywhere you store.

More Product: Buy Flutterwave Verified Account

Related products

-

Payment Merchant

Buy Razorpay Verified Account

Rated 0 out of 5$550.00Original price was: $550.00.$450.00Current price is: $450.00. Add to cart -

Payment Merchant

Buy Paydo Verified Account

Rated 0 out of 5$600.00Original price was: $600.00.$500.00Current price is: $500.00. Add to cart -

Payment Merchant

Buy Braintree Verified Account

Rated 0 out of 5$850.00Original price was: $850.00.$750.00Current price is: $750.00. Add to cart -

Payment Merchant

Buy Adyen Verified Account

Rated 0 out of 5$800.00Original price was: $800.00.$750.00Current price is: $750.00. Add to cart

Reviews

There are no reviews yet.