Buy Fidor Verified Account

- Lifetime Free Support

- 100% legal

- The following Policy

- Full Refunds

- 24/7 Free Support

- Instant Delivery

😊 9 people 5 people 4 people 10 people 7 people are viewing this right now

We accept

Instant Automated Delivery Systems.

😊 41 people 45 people 55 people 43 people 58 people are viewing this right now

We accept

Contact with us 24/7

Telegram: @airvcc

😊 41 people 45 people 55 people 43 people 58 people are viewing this right now

We accept

Table of Contents

ToggleBuy Fidor Verified Account from us

Fidor Bank is a German online financial institution, founded in 2009. In 2015, it commenced a market foray into the United Kingdom. In July 2016, it was announced that Fidor Bank was being obtained with the aid of France’s Groupe BPCE for €100m. As of September 2016, Fidor Bank endured to operate under its branding.

Buy Verified Fidor Accounts – Who can open a Fidor bank account?

Fidor account acquisition is quite simply available to every person who seeks it! Nevertheless, obtaining a SmartCard necessitates the present process of a meticulous evaluation of 1’s creditworthiness, as it is an embossed credit card.

Buy Fidor Accounts – Does Fidor have a banking license?

The establishment of the Bank in Munich in 2009 became made of Matthias Kroner’s entrepreneurial spirit, funded absolutely with the aid of his non-public finances. The Bank currently possesses a Vollbanklizenz, a whole banking license that endows it with the authority to carry out a various range of financial transactions.

Buy Fidor Verified Account – What kind of Bank is Fidor Bank of Germany?

Fidor Bank is a monetary institution that was established in Germany again in 2009. The Bank was founded with the number one goal of rebuilding belief inside the banking zone, and to achieve this, it created patron-centric offerings that allowed clients to interact in decision-making strategies. As a digital bank, Fidor Bank is at the vanguard of banking innovation, providing current services to its clients.

Buy Verified Fidor Account – How many clients does Fidor Bank have?

Starting as a German Challenger Bank, Fidor has in view that multiplied its operations to become a worldwide generation agency. With over four hundred,000 customers, the Bank presently operates the usage of three special business models. Fidor’s ability to continuously adapt and enhance has been an important thing to its success.

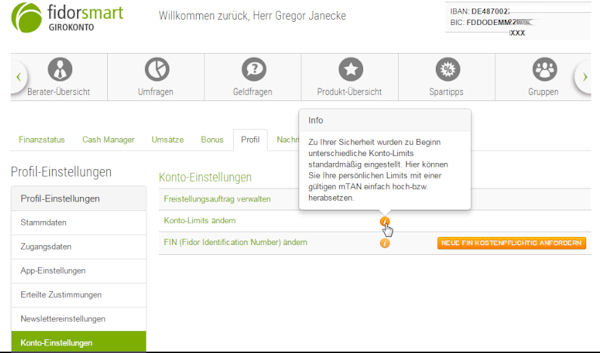

What does the termination include?

The termination includes all products related to your business courting, including your giro and deposit account with the corresponding settlement on interest, your Mastercard ®, and, if granted, your overdraft facility.

I have a savings or lump sum certificate, but will it be paid out?

As a customer with a savings or capital letter, you’ll be contacted one by one by us to explain the early repayment modalities. You will get ahold of your tax certificates from us as typical.

I even have a garnishment protection account.

If your checking account is managed as a garnishment protection account according to § 850k ZPO and is encumbered with a modern-day garnishment, we ask you to word that any credit score stability existing at the time of termination has to be paid out in complete to the creditor. An unused allowance can’t be carried over to the subsequent month because of the termination of the business dating.

What happens to my checking account and my Mastercard ® after termination?

From the time of termination, your online banking functions may be deactivated. Your bank account can now not be used. Transfers, standing orders, and direct debit orders will now not be finished and the Mastercard ® issued can not be used.

More Product: Buy Chase Verified Account

Related products

-

Bank Account

Buy Weststeincard Verified Account

Rated 0 out of 5$300.00Original price was: $300.00.$250.00Current price is: $250.00. Add to cart -

Bank Account

Buy PNC Bank Verified Account

Rated 0 out of 5$500.00Original price was: $500.00.$400.00Current price is: $400.00. Add to cart -

Bank Account

Buy Paysera Verified Account

Rated 0 out of 5$350.00Original price was: $350.00.$300.00Current price is: $300.00. Add to cart -

Bank Account

Buy First Direct Verified Account

Rated 0 out of 5$1,500.00Original price was: $1,500.00.$1,300.00Current price is: $1,300.00. Add to cart

Reviews

There are no reviews yet.