Buy Chase Verified Account

- Lifetime Free Support

- 100% legal

- The following Policy

- Full Refunds

- 24/7 Free Support

- Instant Delivery

😊 9 people 5 people 4 people 10 people 7 people are viewing this right now

We accept

Instant Automated Delivery Systems.

😊 41 people 45 people 55 people 43 people 58 people are viewing this right now

We accept

Contact with us 24/7

Telegram: @airvcc

😊 41 people 45 people 55 people 43 people 58 people are viewing this right now

We accept

Table of Contents

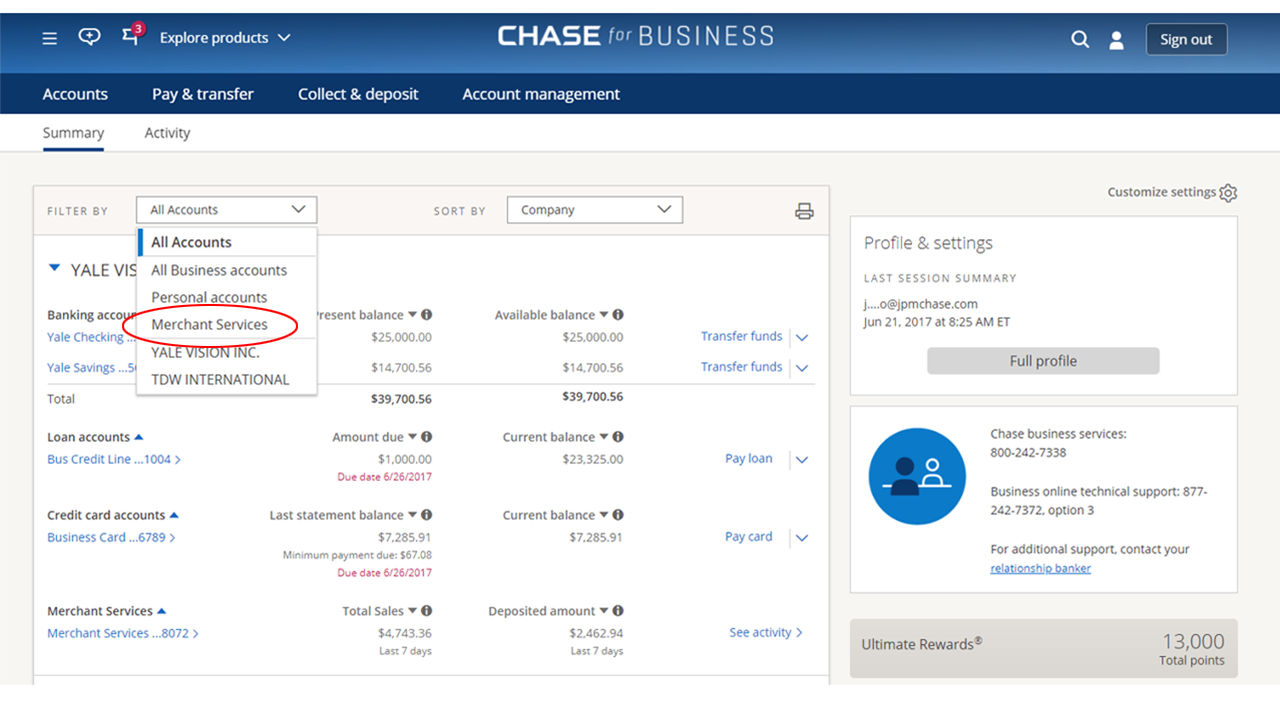

ToggleBuy Chase Verified Account from us

We’re proud to serve hundreds of thousands of humans with a broad range of monetary offerings, inclusive of non-public banking, credit cards, mortgages, auto financing, funding recommendations, small commercial enterprise loans, and fee processing.

Buy Verified Chase Accounts – Is Chase Bank an amazing financial institution?

According to the 2022 J.D. Power U.S. National Banking Satisfaction Study, Chase secured the second role in the ranking. Although Chase offers a first-rate fundamental bank account, its savings quotes are relatively low, and sure charges may be steep and tough to avoid.

Despite its drawbacks, Chase provides a dependable and sincere banking service to its customers. The primary checking account is ready with vital functions that enable customers to perform everyday banking operations effectively. However, the financial savings account quotes are not as aggressive as some of its counterparts within the marketplace.

Customers have to additionally take note of the numerous fees related to their bills, as a few may be on the higher aspect and difficult to keep away from. Nevertheless, Chase remains a viable alternative for people in search of a dependable banking carrier.

Buy Chase Accounts – Is it secure to financial institutions with Chase?

It’s well worth noting that each one of Chase Bank’s money owed is FDIC insured (FDIC# 628) up to $250,000 per depositor, in every account ownership class, in case of any potential bank failure. This coverage gives an brought layer of security for clients, ensuring that their tough-earned money is secure and protected. So, clients can relax assured that their funds are stable, and in the not going event of a financial institution failure, they may be competently compensated by the FDIC.

Buy Chase Verified Account – What is the minimum for a Chase account?

Chase Bank offers checking debts with no minimal stability requirement, which makes it less difficult for clients to open and maintain their accounts. However, retaining a selected balance is one manner to avoid month-to-month charges on certain bills. For example, to keep away from the $12 monthly rate on Chase Total Checking®, customers need to maintain a minimum daily stability of $1,500. This way, they can experience the advantages of the account without being stressed about incurring any additional charges.

It’s essential to observe that each account has special necessities to keep away from monthly costs, so customers need to cautiously evaluate the terms and situations earlier than starting an account. By doing so, they can determine the fine manner to control their debts and keep away from any needless prices.

Buy Verified Chase Account – What are the negative aspects of Chase?

1. Low hobby charges on financial savings products.

2. Not positioned in all states.

3. Requirements to waive month-to-month provider rate.

4. High out-of-network ATM charges.

5. Many banking prices.

6. No retirement bills.

How a good deal is Chase Bank’s monthly rate?

Chase Bank’s most famous account for ordinary use is the Chase Total Checking®. This account doesn’t require a minimal deposit to open, however, it does come with a $12 monthly renovation price. To avoid this fee, clients can meet any of the subsequent requirements: receive not less than $500 in monthly electronic deposits. This feature affords a delivered incentive for clients to apply for the account regularly and guarantees that they can continue to experience its advantages without any extra expenses.

Moreover, Chase Total Checking® offers numerous different capabilities that make it a convenient preference for customers. These functions include online banking, mobile banking, and admission to over sixteen,000 ATMs and four,700 branches. With these advantages, clients can manipulate their budget efficaciously and securely, making their banking experience more convenient and trouble-unfastened.

More Product: Buy Zelle Verified Account

Related products

-

Bank Account

Buy Wirex Verified Account

Rated 0 out of 5$350.00Original price was: $350.00.$300.00Current price is: $300.00. Add to cart -

Bank Account

Buy Vivid.money Verified Account

Rated 0 out of 5$350.00Original price was: $350.00.$300.00Current price is: $300.00. Add to cart -

Bank Account

Buy Paysera Verified Account

Rated 0 out of 5$350.00Original price was: $350.00.$300.00Current price is: $300.00. Add to cart -

Bank Account

Buy Paysend Verified Account

Rated 0 out of 5$300.00Original price was: $300.00.$250.00Current price is: $250.00. Add to cart

Reviews

There are no reviews yet.